As a expert in your field, you're undoubtedly skilled and dedicated to your craft. But financial literacy is equally financial planning for professionals crucial for long-term success. Strengthen a robust understanding of personal finance principles to secure financial stability and freedom. Start by creating a comprehensive budget, analyzing your income and expenses meticulously. Explore various investment options that suit your risk tolerance and financial goals. Don't hesitate to partner with a qualified financial advisor who can provide tailored guidance based on your unique circumstances.

- Emphasize emergency savings to overcome unforeseen financial challenges.

- Decrease unnecessary spending and identify areas where you can save costs.

- Analyze your insurance coverage regularly to ensure it covers your current needs.

By implementing these strategies, you can manage your finances effectively and pave the way for a prosperous future.

Strategic Planning for Career Success

To truly achieve greatness in your career, it's crucial to develop a robust and flexible financial plan. This involves more than just accumulating money; it encompasses understanding your existing financial situation, establishing measurable goals for the future, and utilizing strategies to enhance your wealth. A well-crafted financial plan serves as a roadmap, guiding you towards monetary freedom and thereby allowing you to focus on achieving your professional aspirations.

Elevate Your Wealth: A Professional's Blueprint

Unlocking your financial potential is a journey that requires calculated action. A professional's blueprint provides the foundation to navigate the complexities of wealth management. By utilizing time-tested strategies and harnessing market dynamics, you can achieve your financial objectives.

- A skilled financial advisor can evaluate your unique circumstances and design a personalized plan to align your investments with your long-term plan.

- Diversification is critical for reducing risk and optimizing returns.

- Regular assessment of your portfolio allows you to adjust your strategy in response to evolving market conditions.

Moreover, staying informed about financial trends can offer valuable understanding to make strategic decisions.

Building a Solid Foundation: Building a Secure Financial Future

Securing your financial future requires strategic decisions. Begin by identifying your financial goals. Create a budget that manages your income effectively, emphasizing on both short-term and long-term needs. Investigate various investment vehicles, evaluating the risks and potential returns.

Spread your portfolio across different asset classes to reduce risk. Regularly monitor your investments, making adjustments as needed to match they continue on track with your financial objectives. Remember, building a secure financial future is a ongoing process that requires dedication and patience.

Wealth Management for High Earners

While a high income opens doors to remarkable opportunities, it equally demands a robust understanding of financial literacy. High earners often face unique pressures, ranging from complex investment decisions to estate planning intricacies. Cultivating sound financial habits is essential for preserving wealth, achieving long-term goals, and ensuring a secure future. Building a diversified portfolio, strategically managing debt, and seeking expert advice are key components of financial well-being for those at the top of their game.

- Prioritize long-term growth over short-term gains.

- Understand the intricacies of taxation and estate planning.

- Seek qualified financial advisors who specialize in high-net-worth individuals.

Customized Financial Plans for Experts

In today's dynamic economic landscape, experts require robust financial plans to secure their long-term goals. A tailored financial strategy can help you optimize your assets, minimize your exposures, and achieve your financial aspirations.

- Exploit expert financial guidance to construct a plan that corresponds with your unique needs.

- Allocate your assets across different asset classes to minimize risk and boost returns.

- Strategize for your golden years by optimizing deferred investment {accounts|.

Regularly review your financial plan to confirm it remains appropriate with your changing circumstances.

Mr. T Then & Now!

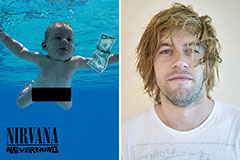

Mr. T Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!